EZGO ANNOUNCES FINANCIAL RESULTS FOR THE SIX MONTHS ENDED MARCH 31, 2021;HIGHLIGHTED BY A 74.3% INCREASE IN REVENUES TO $9.6 MILLION

Jul 01, 2021

JIANGSU, CHINA, June 30, 2021 -- EZGO Technologies Ltd. (Nasdaq: EZGO) (“EZGO” or “we”, “our”, or “the Company”), a leading short-distance transportation solutions provider in China, today announced its unaudited financial results for the six months ended March 31, 2021.

Financial Highlights (all results compared to the prior year period unless otherwise noted)

• Revenues were $9.6 million, an increase of 74.3%

• Units sold reached 34,069, an increase of 96.6%

• Gross margin was 9.7%, compared with 9.6%

• Net loss was $0.3 million, compared with net loss of $0.6 million

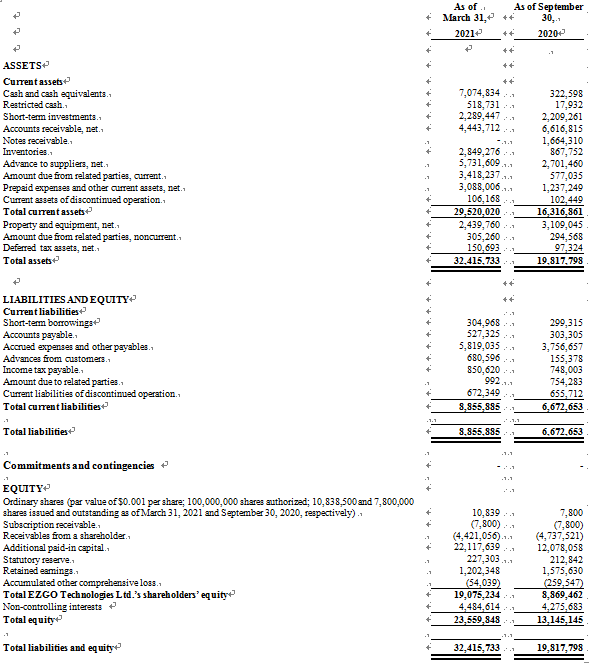

• The Company has cash and cash equivalents of approximately $7.1 million at March 31, 2021, compared to approximately $0.3 million at September 30, 2020

Management Commentary

Mr. Jianhui Ye, Chief Executive Officer of EZGO, stated, "The last six months have been a monumental period in EZGO’s development, highlighted by our IPO in January 2021 and transition from an expert in battery technology into a manufacturer of e-bicycles. We reported strong growth in both revenues and the number of units sold, as the demand for our products has continued to grow due to greater brand awareness. We achieved this growth despite capacity restraints that restricted our ability to meet this continued demand, and as a result, we recently announced the purchase of land and property that we believe will allow us to initially increase our production capacity by 100,000 units of two-wheeled e-bicycles. In addition, the estimated production capacity of the factory building expected to be built on the remaining land being purchased is anticipated to be approximately 500,000 units.”

Mr. Ye concluded, “In the coming months, we are focused on both utilizing our increased capacity as well as expanding our marketing efforts and product development and innovation. We have introduced 15 new two wheeled e-bicycles, mopeds and leisure e-tricycles over the last six months, while investing in R&D as a means of integrating our battery expertise with new IoT technology that will improve performance. We are pleased with our progress made to date and remain very optimistic about our growth prospects for the future.”.

Financial Review for the Six Months Ended March 31, 2021

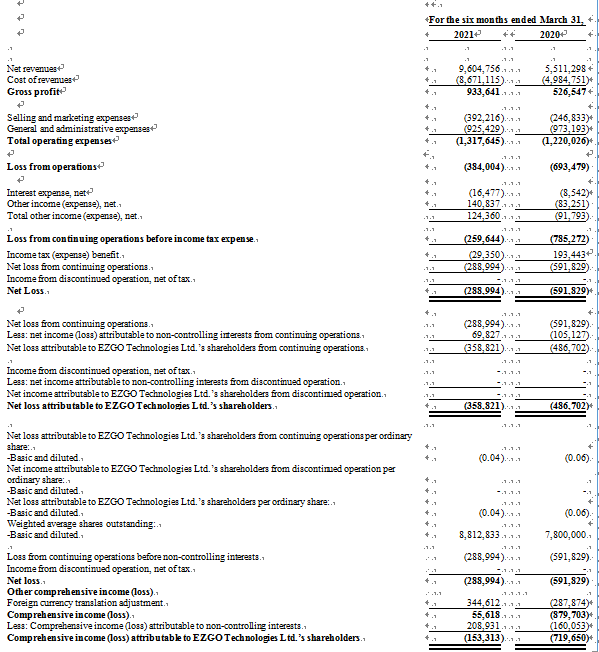

Net Revenues

Net revenues from continuing operations for the six months ended March 31, 2021 were approximately $9.6 million, a 74.3% increase from approximately $5.5 million for the six months ended March 31, 2020. The significant increase in revenues were mainly driven by the increase of sales of e-bicycles, and partially offset by the decrease of rental revenue.

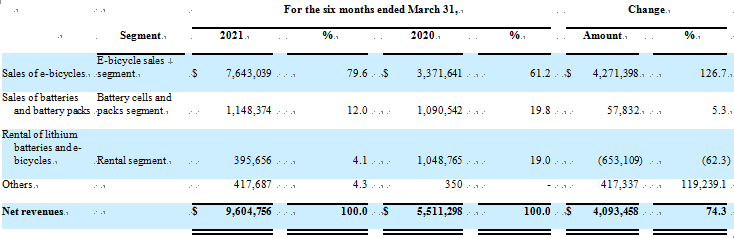

The following table identifies revenue from continuing operations and reportable segments for the six months ended March 31, 2021 and 2020:

The e-bicycles sales segment engaged in online and offline sales of e-bicycles. The revenue of sales of e-bicycles increased to approximately $7.6 million, or approximately 126.7%, for the six months ended March 31, 2021 as compared to the same period in 2020, mainly due to the launch of new products, a rapid growth in the Company’s offline e-bicycles sales market, and the mitigated impact of COVID-19 since the second quarter of 2020.

The revenue from battery cells and packs segment for the six months ended March 31, 2021 and 2020 were both approximately $1.1 million, a 5.3% increase derived from continuing relationships with long-term customers.

The revenue from rental segment significantly decreased by approximately $0.7 million, or approximately 62.3%, for the six months ended March 31, 2021 as compared to the six months ended March 31, 2020, primarily due to the termination of three rental contracts from our sublease agents during January, May and July 2020.

Cost of Revenues

Our cost of revenues significantly increased by approximately $3.7 million, or approximately 74.0%, to approximately $8.7 million for the six months ended March 31, 2021 from approximately $5.0 million for the six months ended March 31, 2020, which was primarily due to the increase of manufacturing and purchase cost of e-bicycles for sale. The increase was in line with the increase in our net revenues.

Gross Profit

Gross profit for the six months ended March 31, 2021 and 2020 was approximately $0.9 million and $0.5 million, representing 9.7% and 9.6% of net revenues, respectively. The Gross profit margin were relatively consistent during these two periods primarily due to the sales of e-bicycles accounting for a large proportion of our total revenue, thus, the total gross profit rate converged with that of sales of e-bicycles.

Selling and Marketing Expenses

Our selling and marketing expenses primarily consist of salaries and benefits expense, advertising expense, and freight expense. Our selling and marketing expenses increased by approximately $0.1 million or approximately 58.9%, to approximately $0.4 million for the six months ended March 31, 2021 from approximately $0.2 million for the six months ended March 31, 2020. Such increase consisted of the increase of salaries and benefits expense and advertising expense, which resulted from the recruitment of new salespersons with the Company’s business expansion on sales of e-bicycles and the promotion of sales of e-bicycles during this period.

General and Administrative Expenses

Our general and administrative expenses decreased by approximately $48 thousand or approximately 4.9%, to approximately $0.9 million for the six months ended March 31, 2021 from approximately $1.0 million for the six months ended March 31, 2020. The decrease was mainly due to lower R&D expenses for the six months ended March 31, 2021, and partially offset by an increase in professional fees. However, after the IPO in January 2021, we plan to invest more funds in R&D in the future.

Income Tax Expense

Income tax expense amounted to approximately $29 thousand for the six months ended March 31,2021 and income tax benefit amounted to approximately $0.2 million for the six months ended March 31, 2020, respectively. The income tax benefit was recognized as our PRC subsidiaries suffered deductible loss for the six months ended March 31, 2020, and our PRC subsidiaries had a taxable income for the six months ended March 31, 2021.

Net Loss

Net loss for the six months ended March 31, 2021 was approximately $0.3 million, compared to approximately $0.6 million for the same period in 2020, mainly due to the above reasons.

About EZGO Technologies Ltd.

Leveraging an Internet of Things (IoT) product and service platform and two E-bicycle brands, “Cenbird” and “Dilang”, EZGO has established a business model centered on the manufacturing and sale of E-bicycles and E-bicycle rentals, complemented by the E-bicycle charging pile business. For additional information, please visit EZGO’s website at www.ezgotech.com.cn. Investors can visit the “Investor Relations” section of EZGO’s website at https://www.ezgotech.com.cn/Investor/.

Exchange Rate

This announcement contains translations of certain Chinese Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the readers. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB 6.5518 to US$ 1.00, the exchange rate in effect as of March 31, 2021, as set forth in the H.10 Statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance; changes in technology; economic conditions; the growth of the short-distance transportation solutions market in China and the other international markets the Company plans to serve; reputation and brand; the impact of competition and pricing; government regulations; fluctuations in general economic and business conditions in China and the international markets the Company plans to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the Securities and Exchange Commission (“SEC”). For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward‐looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

At the Company:

Shawn Wen

Email: ir@ez-go.com.cn

Phone: (+86) 13502829216

Investor Relations:

Adam Prior

The Equity Group Inc.

Email: aprior@equityny.com

Phone: (212) 836-9606

Shawn Wen

Email: ir@ez-go.com.cn

Phone: (+86) 13502829216

Investor Relations:

Adam Prior

The Equity Group Inc.

Email: aprior@equityny.com

Phone: (212) 836-9606

EZGO TECHNOLOGIES LTD.UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS(In U.S. dollars except for number of shares)

EZGO TECHNOLOGIES LTD.UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF INCOME AND COMPREHENSIVE INCOME (LOSS)(In U.S. dollars except for number of shares)